Working to a proven and strategic methodology, I will personally provide you with prompt, realistic and implementable GST solutions for your deepest GST concerns and keep you safe from the ATO and others. GST can sometimes be, or just appear to be, complex or uncertain. My role is to untangle and simplify it for you. Many call me MR GST for a reason.

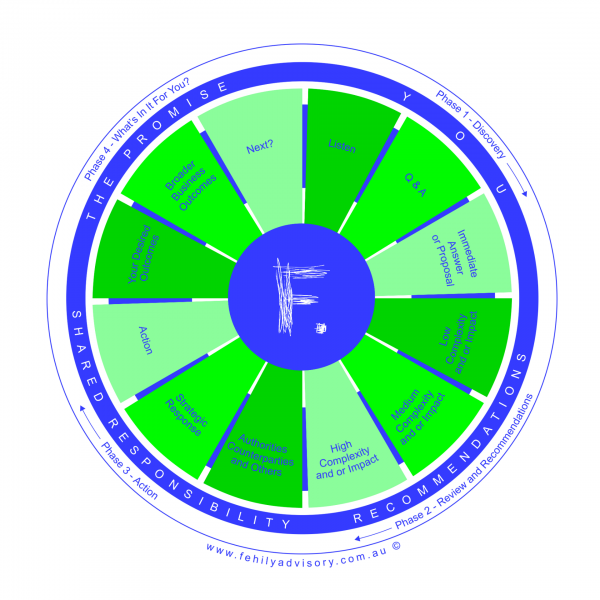

In Phase 1, after carefully listening to what you think your GST problems, needs or opportunities are, and after sharing some brief Q&As, I will focus directly on the real issues and endeavour to get straight to the punch with an answer and recommendations. The goal is to be direct, clear and without sugar-coating, as you will want and deserve the truth. The real GST issue is very often not what you might think it is.

If the answer is not immediately achievable, we may move to Phase 2 in which you will likely provide further relevant information and documents for my review and consideration. That will be for me to determine the level of complexity and impacts of the GST issues as well as the solutions, and what your options are. My recommendations will be directed to the best achievable outcomes and a definitive path forward for you, so you can sleep at night without worrying about GST. The form of delivery will normally initially be by way of practical meetings/discussions/Zooms between us rather than endless long technical written opinions that don’t identify the real issues or impacts for you, or what next steps are best done by who, how and when. Drawing on my experience in resolving virtually all forms of indirect tax matters over the past four decades, I will again endeavour to provide definitive answers and recommendations at which point you should not be left wondering.

If appropriate, and with your approval, we may need to move forward to Phase 3. That could involve dealing with the ATO if they have already contacted you with questions or have commenced a review or audit. On the other hand, we may wish to contact them to challenge their decisions, seek refunds or request private rulings. In such situations, all communications to and from the ATO will normally be through me, so you don’t have to face them. It could involve other action or discussions with your business colleagues or stakeholders, other contractual parties and/or their advisors or others in the marketplace like competitors, suppliers or customers. We will agree on who the best person is to do what, as the best action to take is often multifaceted and best carried out by you, me, your current advisors or others as appropriate. It is often best achieved by us all acting together with constant and effective real-time communication. You will be fully informed at all times, and in control.

Phase 4 might sometimes arise when actions are to be carried forward by you or your organisation concerning the current GST matters, other GST pains that need to go away or be avoided or new opportunities to be taken up. Best efforts will be made to best empower you and your team to do what can be done by you, and also with my backing that is always available to you. Favourable GST outcomes often result in new funds becoming available that were not available before. What you or your business do with those funds is often at your discretion, and I have worked with many clients to work out what the best approach is for their business at that time. That could be reduced prices, increased profitability or funding new projects internally or in the marketplace. Achieving a favourable 10% GST outcome is not ‘just 10%’, nor is it ‘just about the GST’. 10% is huge and could be more than your net profit. Let’s work on that together.